Required minimum distribution 2021 calculator

Calculate your earnings and more The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. The IRS released final regulations effective January 1.

/retirement_iras_shutterstock_537341107-5bfc47c846e0fb002607e592.jpg)

6 Important Retirement Plan Rmd Rules

Distribution period from the table Table III for your age on your birthday this year.

. Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distribution RMD. Line 1 divided by number entered on line 2. This is your required minimum distribution for this year from this.

Ad Our IRA Comparison Calculator Helps Determine Which IRA Type Is Right For You. Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

The IRS requires that you withdraw at least a minimum amount - known as. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Determine beneficiarys age at year-end following year of owners death.

Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Use oldest age of. An RMD is the minimum amount of money you must withdraw annually from your qualified retirement plans after reaching age 72 or 705 if you were born before July 1 1949. These withdrawals are called.

You will need to calculate your RMD each year because it is based on your current age and account balances at the prior year-end. The SECURE Act of 2019 changed the age that RMDs must begin. Our Resources Can Help You Decide Between Taxable Vs.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Maya inherited an IRA from her mother. If you were born on or after.

You can withdraw more than the minimum required amount. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021. How is my RMD calculated.

Your life expectancy factor is taken from the IRS. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Distributions are Required to Start When You Turn a Certain Age. Visit The Official Edward Jones Site. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and.

Divide the total balance of your account by the distribution period. New Look At Your Financial Strategy. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Once you reach age 72 the IRS requires you to withdraw a minimum amount each year from certain IRAs.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. What are required minimum distributions. Make sure you do this for all of the traditional IRAs you have in.

Account balance as of December 31 2021. This is your required minimum distribution. Your required minimum distribution is the minimum amount you must withdraw from your account each year.

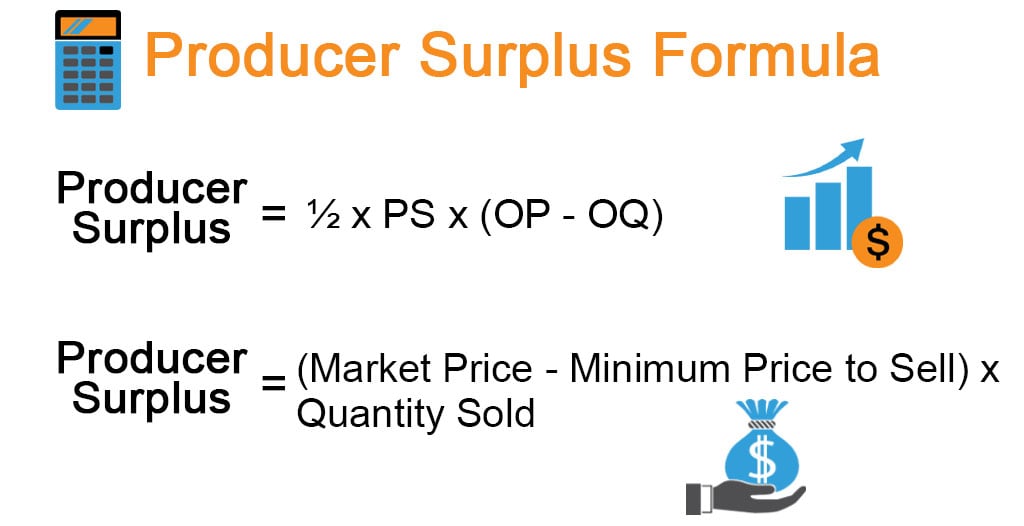

Producer Surplus Formula Calculator Examples With Excel Template

Required Minimum Distribution Time To Withdraw Ira Funds

Lincoln Investment Required Minimum Distribution Rmd

Ap Computer Science A Score Calculator For 2022 Albert Io

Confused By The New Secure Act S 10 Year Rule For Inherited Iras

Inherited Ira Rmd Calculator Td Ameritrade

Irs Proposal Conforms 401 K Required Withdrawals With The Secure Act

Irs Letter 5759c Required Minimum Distribution Not Taken H R Block

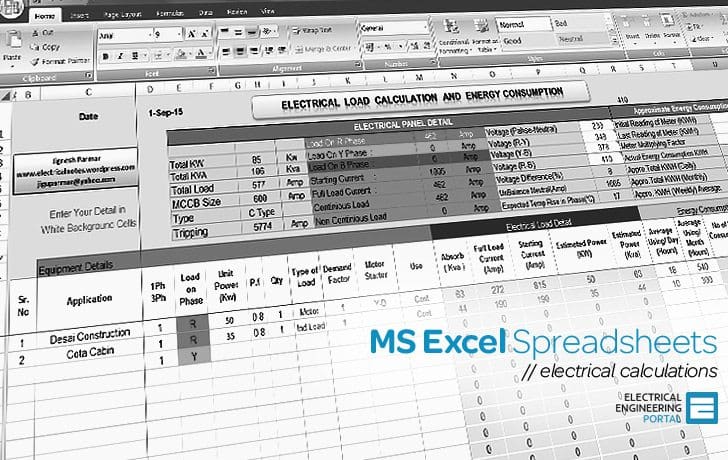

Electrical Ms Excel Spreadsheets

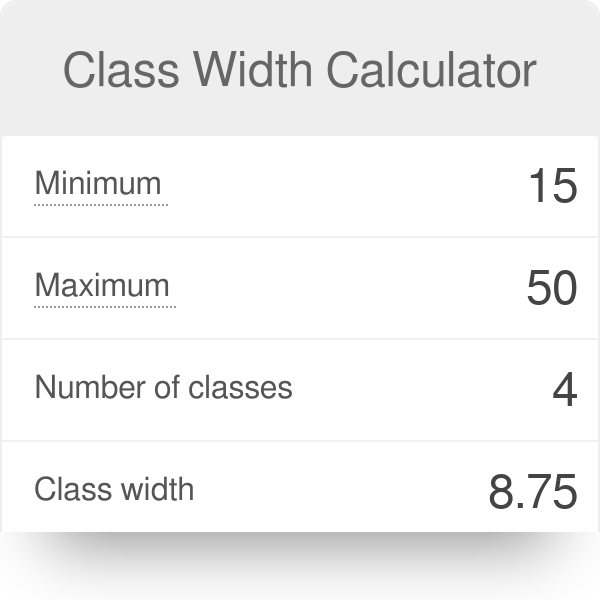

Class Width Calculator

Whole Hog Value Calculator Pork Information Gateway

Required Minimum Distributions Rmds Are You Ready

Required Minimum Distribution Rmd Rules For 401 K Sofi

Required Minimum Retirement Plan Distributions By Plan

Business Office Sence Paid Ad Affiliate Sence Office Business Budget Calculator Money Organization Monthly Budget Calculator

Required Minimum Distribution Rmd Immediateannuities Com

How To Calculate Percentiles From Mean Standard Deviation Statology